Airbnb & Vrbo vs. Short-Term Vacation Rental Regulation: How to Reach Your Target Audience with Tunnl’s Prebuilt Audiences

Teddy joined Tunnl in January of 2020 and is currently the Senior Director of Account Management for Agencies.

Short-term rental (STR) legislation throughout the country may change the way Americans travel in the very near future. As travelers continue to enjoy the variety of accommodations on Airbnb and Vrbo, local and state lawmakers are struggling to keep residents happy, housing affordable, and tourism successful.

The motivations and needs of businesses, homebuyers and renters, hotel unions, hosts, travelers, and policymakers are all in conflict, inspiring a spike in issue-based campaigns for or against the regulation of short-term rentals. How do you ensure yours is the one that gets seen by the right people?

Seeing the trend toward industry instability and an uptick in regulatory policy, Tunnl’s data scientists preemptively polled the nation on short-term rental issues to measure favorability for the leading brands and legislation as a whole. We created five prebuilt audiences complete with demographic and media mix insights you can use right now to reach the right people with your public affairs or issue advocacy campaigns for or against short-term rental regulation.

- Pro Government Regulation Short Term Rentals: Individuals who support state control of short-term rentals over local government control

- Anti Government Regulation Short Term Rentals: Individuals who oppose state control of short-term rentals over local government control

- Persuadable Government Regulation Short Term Rentals: Individuals who are persuadable on the issue of state versus local government control over short-term rentals

- Vrbo Favorable: Individuals who have a favorable view of Vrbo (Vacation Rentals by Owner)

- Airbnb Favorable: Individuals who have a favorable view of Airbnb.

Which audience is ideal for your campaign? We’ll offer more context on what’s happening in the short-term rental industry right now and walk you through who is in each of Tunnl’s five short-term rental audiences so you can buy against the one that’s right for you.

Short-Term Rental Regulations, Hotel Prices, and the Current State of Airbnb and Vrbo

After years of scattered quarantines and health fears, Americans are traveling again, with nearly half of our 336,856,703-person population reporting they have plans to travel more in 2023. And although 62% of Americans report they're planning to spend more money on travel this year, they still want the most bang for their buck, meaning many are avoiding hotels.

The price of a hotel room has been fluctuating since 2020 with rates steeply increasing since the pre-pandemic era. With hotels costing travelers up to 54% more in 2023 than in previous years, and with many traditional accommodations offering fewer or less frequent services like daily cleaning, Americans are looking elsewhere for a place to lay their head on vacation.

Short-term rentals like those offered by Airbnb and Vrbo have enjoyed healthy post-pandemic demand as a flexible, affordable hotel alternative. These lodging services give travelers more options and flexibility in where they stay, even offering novel experiences to boot. Short-term renters can choose to stay in a converted World War II train car, in a treehouse, or make themselves at home in a subdued and private bungalow in the heart of a city suburb.

options and flexibility in where they stay, even offering novel experiences to boot. Short-term renters can choose to stay in a converted World War II train car, in a treehouse, or make themselves at home in a subdued and private bungalow in the heart of a city suburb.

But with the surge in short-term rental popularity came a surge in short-term rental businesses and investors seeking desirable properties. With more short-term rentals popping up, quiet neighborhoods have become disrupted by raucous travelers and sometimes-garish properties and marketing activations like Barbie’s Malibu DreamHouse on Airbnb, creating noise, trash, parking, and safety concerns that local residents and governments are struggling to manage.

And communities across America are reporting a “crisis level” of rental housing like the popular vacation destination, Nantucket, MA. With fewer homes available to rent and buy, the property value of those available has skyrocketed, forcing many to leave their neighborhood in search of one that’s more affordable at such a rate that it’s even impacting the overall supply of affordable housing.

But residents aren't the only ones at war with short-term rentals. For years, hotel unions in major tourist destinations like New York City and Los Angeles have spent millions of dollars advocating for local restrictions on short-term rental hosts and companies like Airbnb and Vrbo. Victories have been incremental, like limiting rental periods to no more than 90 days annually and restricting hosts to renting out their primary residence, and have often required government intervention to take shape.

But residents aren't the only ones at war with short-term rentals. For years, hotel unions in major tourist destinations like New York City and Los Angeles have spent millions of dollars advocating for local restrictions on short-term rental hosts and companies like Airbnb and Vrbo. Victories have been incremental, like limiting rental periods to no more than 90 days annually and restricting hosts to renting out their primary residence, and have often required government intervention to take shape.

Some governments have taken matters into their own hands to begin laying down the law on short-term rentals, introducing legislation that restricts or regulates their operation, or that bans them altogether, as Colorado did in April 2023. The debate about how to manage the short-term rental industry and who gets to decide continues to rage on as local governments disagree with state officials on how to best balance profitable tourism, resident retention, public safety and health, and citizens’ wellbeing.

Increasingly, the debate is reaching the public and policymakers, encouraging both to take a stance, often with their dollars and votes.

Get Your Short-Term Rental Campaigns in Front of the Right People

Legislation on short-term rentals is being made right now, and if you have a stake in the debate, it’s critical that you get your message in front of the people you need to impact, right away. To run a campaign that drives actual impact and avoids wasted ad budget, when you build your targeting strategy, you need to know who is on your side, who has made up their mind against you, and who is still on the fence about what’s next for short-term rentals.

Tunnl asked Americans across the nation if they support or oppose a bill that extends state control of short-term rentals and limits the ability of local governments to regulate short-term rentals. This created three audiences: pro-government regulation, anti-government regulation, and people who are persuadable on the subject.

We also asked them directly how they view the short-term rental juggernauts Airbnb and Vrbo, on a scale of Very Favorable to Very Unfavorable, with options for uncertainty or unawareness about the brand, yielding two more audiences.

Let’s dig into who landed in each camp.

Pro Government Regulation Short Term Rentals

Audience Definition: Individuals who support state control of short-term rentals over local government control

Audience Size: 19,558,845 (6%) Adults Nationwide

When we asked about expanding state control of short-term rentals and limiting local government interference, this group of people was all in favor. Approximately 19.5 million adults nationwide were strongly or moderately in favor of keeping state governments in control of short-term rentals.

Of those 19.5 million people, more than two-thirds of them are between the ages of 25 and 44. Most of the people in this group are male, are registered Democrats, and have incomes over $100,000 annually.

Glancing at a map of the audience shows that members of the Pro Government Regulation Short Term Rentals audience are concentrated in coastal states. This could be an indicator of hosts residing in popular vacation destinations who prefer the lenient state regulatory approach over the more critical local government restrictions proposed in communities throughout the country.

The demographic breakdown of this audience could alternatively suggest frustrations from young people facing high housing costs because of STR saturation in their areas, leading to advocacy for state intervention.

Consult Tunnl's Audience Builder

Using Tunnl’s Audience Builder, we analyzed an overlap of the Pro Government Regulation Short Term Rentals audience with our prebuilt Homeowners audience. Of the 19.5 million people in this audience who support state control of short-term rentals, only about 11 million of them are homeowners.

At any rate, this audience is an ideal target for public affairs and issue advocacy campaigns aiming to gain support for state-wide legislation on short-term rentals or deter local government initiatives around STRs.

Now, who’s on the other side of the issue?

Anti Government Regulation Short Term Rentals

Audience Definition: Individuals who oppose state control of short-term rentals over local government control

Audience Size: 38,389,274 (12%) Adults Nationwide

Roughly 38 million strong, this group of people is opposed to giving states more control over short-term rentals - and its about twice as large our Pro Government Regulation Short Term Rentals audience.

This audience skews older, with 80% of them falling between the ages of 55 and 70+. The are overwhelmingly Republican and white, with varied income and education levels. They are also distributed across the entire country.

There’s a clear bipartisan divide between this Anti Government Regulation Short Term Rentals audience and the people in its Pro counterpart. Republican advocacy for small government aligns with this group’s resistance to state control of short-term rentals.

Consult Tunnl's Audience Builder

Using Tunnl's Audience Builder, we analyzed an overlap of the Anti Government Regulation Short Term Rentals audience with our prebuilt Homeowners audience. Of the 38 million people in this audience who are opposed to state control of short-term rentals, 30 million of them are homeowners.

To see additional, granualar cross sections of people who are against state government regulation of short-term rentals and support other issues you're campaigning on, use the Audience Builderto create your own custom short-term rental segments in minutes by combining, excluding, and overlapping hundreds of prebuilt issue-based audiences based on demographics, geographic radiuses, and interests.

Some people in the Anti Government Regulation Short Term Rentals may be property owners renting out their spaces on Airbnb and Vrbo who don’t want the state stepping in to criminalize their business. They may be settled into neighborhoods where vacation rentals are common and trust their local officials to make the best calls on how to improve trash, parking, and noise issues.

Either way, they want the power to regulate STRs to stay with local governments. Use this audience to connect with people who are likely to vote against state regulation of short-term rentals or for campaigns advocating for local control over the STR industry.

We know who supports regulation and who’s opposed to it. Who falls somewhere in between?

Persuadable on Government Regulation Short Term Rentals

Audience Definition: Individuals who are persuadable on the issue of state versus local government control over short-term rentals

Audience Size: 56,124,567 (18%) Adults Nationwide

Though there are clear groups both for and against state control over short-term rentals, there’s a larger group - about 56 million people - still on the fence.

The Persuadable on Government Regulation Short Term Rentals audience is represented throughout the country. Their demographics show an even spread of ages and incomes, with 56% of them identifying as Independents.

This group is still making up their minds about who should have control over short-term rental regulation. They’ll be the perfect audience to target if you want to sway opinions in one direction or the other for your state or local initiative. You can reach this audience where they're most likely to see and engage with your message using the media mix insights available in the Tunnl Platform.

So that’s how America sees the short-term rental industry, but what do they think about its key players, Vrbo and Airbnb?

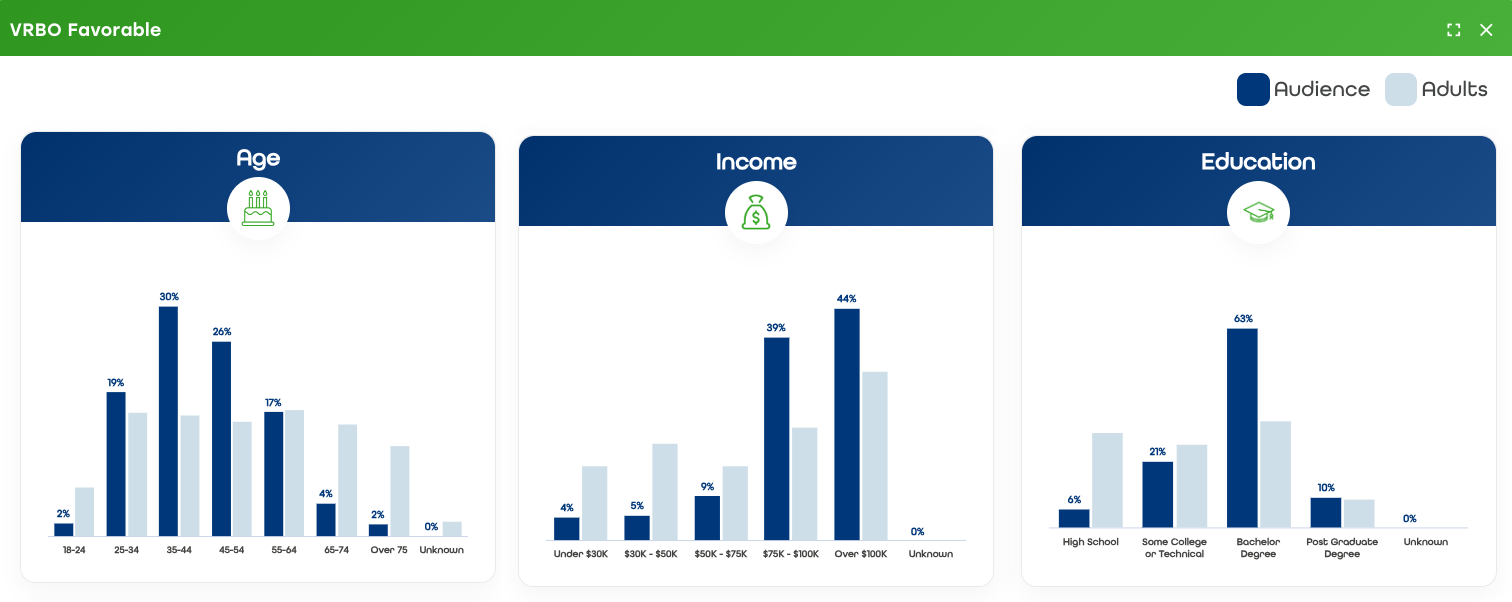

Vrbo Favorable

Audience Definition: Individuals who have a favorable view of Vrbo (Vacation Rentals by Owner)

Audience Size: 49,063,442 (15%) Adults Nationwide

Vrbo, an acronym for Vacation Rentals by Owner, is a short-term rental company owned by Expedia Group. With more than 2 million properties available for rent, Vrbo is a popular hotel alternative for families, large groups, and people traveling with pets.

In our survey, Tunnl asked Americans to rate how they felt about Vrbo using the following options:

- Very Favorable

- Somewhat Favorable

- Somewhat Unfavorable

- Very Unfavorable

- I’m unaware of this company

- Unsure

Their answers and our proprietary data modeling process helped to create the Vrbo Favorables audience, comprised of 49 million people who have a positive opinion on the vacation rental company.

While their incomes are high (about 75% of them earn over $75k annually), this audience skews younger with 70% of the Vrbo Favorables being under 50 years old. They are predominantly female and more than half of them have bachelor’s degrees.

This audience could be critical to your short-term rental regulation campaigns, as they have a vested interest in preserving their vacation rental options, including Vrbo.

This next audience could be similarly helpful: Airbnb Favorables.

Airbnb Favorable

Audience Definition: Individuals who have a favorable view of Airbnb

Audience Size: 39,619,926 (13%) Adults Nationwide

Airbnb has become synonymous with the short-term rental industry, offering travelers more than 6 million different lodging options from more than 4 million hosts around the world. And while its reputation precedes it, Airbnb isn’t as favorable as Vrbo.

We asked Americans to rate how they felt about Airbnb on the same scale:

- Very Favorable

- Somewhat Favorable

- Somewhat Unfavorable

- Very Unfavorable

- I’m unaware of this company

- Unsure

The survey responses we gathered helped us model the Airbnb Favorable audience, consisting of 39.6 million people who have a positive opinion of the vacation rental giant. Though they represent a similar age range to the Vrbo Favorable audience, Airbnb Favorables skew a touch younger and are a bit more racially diverse. They also have a broader spread of education and are predominantly Democrats.

Knowing that this group favors Airbnb can help you reach an audience of short-term rental advocates. It can also help you exclude people who won’t be as receptive to your STR regulation messaging. Try out Tunnl's Audience Builder to overlap, unite, or exclude any of our hundreds of audiences for more niche targeting in minutes.

Get Started with Tunnl's Prebuilt Audiences to Get Your Message on Short-Term Rentals Heard By the Right People

Whether you stand with state or local governments, work on behalf of hotel unions, or simply want to reach travelers who prefer short-term rentals, the future of your organization could be in the hands of regulators. While travel is high on everyone’s mind - vacationers and legislators alike - you have an opportunity to inform and influence public opinion on short-term rentals from companies like Airbnb and Vrbo.

To use these audiences in your public affairs and issue advocacy campaigns, demo Tunnl's platform. Explore additional layers of audience intelligence with Tunnl's Audience Builder, to quickly create short-term rental segments combining, excluding, and overlapping prebuilt audiences to reach your target niche.

And when you've found the right people for your short-term rental regulation message, buy against your Tunnl data in digital ad platforms and DSPs with the click of a button.

Travel is poised to change throughout the nation. Will it go your way?